In 2023, the European Investment Bank (EIB) committed €44.3 billion to climate action and environmental sustainability, representing 60% of its annual lending. This substantial investment is part of the EIB’s broader goal to support €1 trillion in green financing by 2030.

What are Green investments?

The practice of choosing assets with an emphasis on their environmental impact is referred to as “green investing,” or “eco-friendly investing.” There are other names for it, such as environmental investing and eco-investing. The focus on the environmental impact of investments and traditional instruments with underlying assets that fulfill certain environmental requirements distinguishes green investing from impact investing and Environmental, Social, and Governance (ESG) investing, which are sometimes conflated. This covers companies and endeavors that follow environmentally friendly procedures and cutting-edge technologies that help the globe move toward net zero.

By offering the financial services and products required to finance sustainable projects, green finance plays a critical role in facilitating green investments.

The financial services industry does not, however, have a consensus definition of “green investments,” which makes eco-friendly investing difficult for private investors. Finding assets that fit both financial objectives and environmental principles needs a great deal of experience, illustrating the complex relationship between green finance and green investments.

What is Green Finance?

For two reasons, we still lack a clear and widely recognized definition of green finance. The word is not defined in many publications, and the ones that are offered differ greatly from one another. The following are a few definitions that are included in the resources:

- According to Gilbert, “green finance” is a general word that may be used to describe financial investments made into environmental products, policies that support the growth of a more sustainable economy, and programs and activities related to sustainable development.

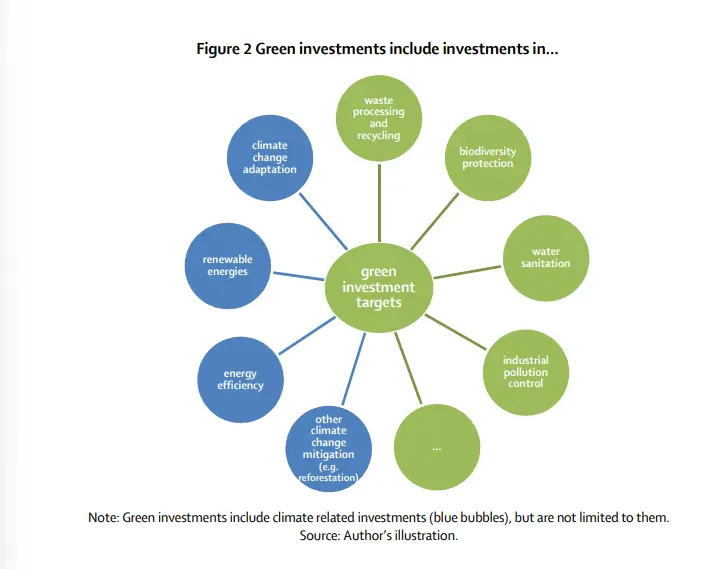

Climate financing is a subset of green finance, although it is not the only one. It also alludes to a broader variety of additional environmental goals.

Such as biodiversity preservation, water cleanliness, or industrial pollution control. Finance for adaptation and mitigation is particularly tied to climate-related activities: Investments in projects and programs that help reduce or avoid greenhouse gas emissions (GHGs) are referred to as mitigation financial flows, while investments that help make goods and people less vulnerable to the effects of climate change are referred to as adaptation financial flows.

- Green finance and green investment are frequently used interchangeably, according to Zadek and Flynn (2013).

- According to Pricewaterhouse Coopers Consultants (2013), green finance for the banking industry is defined as financial products and services that take environmental factors into account during lending decision-making, ex-post monitoring, and risk management processes. These services and products are offered to encourage environmentally conscious investments and low-carbon technologies, projects, industries, and businesses.

Proposal of a definition of green finance:

Green finance comprises

- The funding of green initiatives in the following sectors, both governmental and private, including initial and ongoing expenses

-> Environmental goods and services

(such as water management or protection of biodiversity and landscapes)

-> Prevention, minimization, and compensation of damages to the environment and the climate. ( (such as energy efficiency or dams) - The funding of public policies (including operating expenses) that promote the adoption of environmental projects and initiatives, such as feed-in tariffs for renewable energy, that mitigate or adapt to environmental damage.

- Elements of the financial system that focuses exclusively on green investments, like the Green Climate Fund, or financial products for green investments, including structured green funds and green bonds, along with the unique institutional, legal, and economic framework conditions

Green Investment Returns

Although financial growth is still a significant factor in environmental investments, investment returns are not the main objective. It is challenging to evaluate green investments’ potential for producing significant returns because they are a relatively new class of financial instruments with less historical data than traditional assets.

Nonetheless, there are some signs that eco-friendly investments don’t necessarily translate into decreased profits. According to a 2021 Morningstar Inc. analysis, the majority of sustainable funds outperformed their respective Morningstar Category benchmarks in terms of both total and risk-adjusted-performance. One of the components of ESG criteria is environmental variables, and some research indicates that higher ESG scores may be a sign of longer-term performance that is above average. However, please remember that an investment’s historical performance does not ensure future results.

Many investors think that making environmentally aware investments gives them the highest chance of making long-term profits in the future, even in the absence of clear historical evidence. The need for businesses to take responsibility for and be open about their environmental impact is growing as the effects of human activity on climate change become more obvious.

Businesses and organizations that use antiquated and unsustainable methods will probably have to deal with increased expenses and regulatory obstacles as the world shifts in this new direction, which may limit their capacity to provide investors with profits. On the other hand, businesses and groups that successfully promote change and adopt sustainability measures may thrive.

Conclusion

A revolutionary change in the financial landscape, green finance, and investments highlight the twin goals of economic expansion and environmental sustainability. Even though the industry is still in its infancy, the growing demand for environmentally friendly projects around the world and the incorporation of environmental considerations into investment choices point to a bright future. Green finance gives investors the chance to have a real impact on the environment in addition to earning financial gains. The shift to a greener economy will open up new opportunities as awareness and innovation increase, resulting in a robust and sustainable financial ecosystem for future generations.

Sources: Green bank Investments cbd QuantumLearn